cryptobuy.site Overview

Overview

Top Joint Bank Accounts

Opening a joint checking or savings account with someone close to you can help you spend, save and monitor money more efficiently. John and Mary Smith have a joint savings account with $, at Any Bank. This is their only account at this IDI and it is held as a “joint account with right. SoFi joint bank accounts have no account fees, unlimited transfers, and up to % APY. See why SoFi was voted the Best Joint Checking Account of What is a joint bank account? · receive payments, like wages, benefits and pension · pay for things or take out cash with a debit card · transfer money to pay. by pairing Bank Smartly® Savings with a Bank Smartly® Checking or Safe Debit account and combined qualifying balances and Bank Smartly® Savings balances of at. Why a joint bank account may be best for you? · Mortgage · Rent · Groceries · Utility bills. Opening a joint account can be a strong financial tool, but it's important to be realistic about the potential drawbacks. Weigh these top pros and cons of joint. Not sure which checking account is the best fit? Compare all checking Joint checking accounts must be opened at a branch. Make an appointment to. Couples can use cash in a joint checking account to cover shared expenses such as rent, bills and date nights. · A joint savings account can help you save more. Opening a joint checking or savings account with someone close to you can help you spend, save and monitor money more efficiently. John and Mary Smith have a joint savings account with $, at Any Bank. This is their only account at this IDI and it is held as a “joint account with right. SoFi joint bank accounts have no account fees, unlimited transfers, and up to % APY. See why SoFi was voted the Best Joint Checking Account of What is a joint bank account? · receive payments, like wages, benefits and pension · pay for things or take out cash with a debit card · transfer money to pay. by pairing Bank Smartly® Savings with a Bank Smartly® Checking or Safe Debit account and combined qualifying balances and Bank Smartly® Savings balances of at. Why a joint bank account may be best for you? · Mortgage · Rent · Groceries · Utility bills. Opening a joint account can be a strong financial tool, but it's important to be realistic about the potential drawbacks. Weigh these top pros and cons of joint. Not sure which checking account is the best fit? Compare all checking Joint checking accounts must be opened at a branch. Make an appointment to. Couples can use cash in a joint checking account to cover shared expenses such as rent, bills and date nights. · A joint savings account can help you save more.

What is a joint bank account? · receive payments, like wages, benefits and pension · pay for things or take out cash with a debit card · transfer money to pay. For some couples, settling on a hybrid approach for money management works best. Each person maintains a separate account while both establish a new joint. You might be familiar with joint checking accounts, but sharing your finances doesn't have to end there. How does a joint savings account work? A joint savings. Learn about the benefits of a Chase checking account online. Compare Chase checking accounts and select the one that best fits your needs. No bank is a good place to open a joint account with a boyfriend. You don't want that kind of headache if something happens to the relationship. A joint savings account can be a convenient way to share the responsibility of mortgage repayments and household bills with two or more other people. If you own an asset (for instance a house or bank account) in joint tenancy with a right of survivorship with your spouse then on your death % of that. What are the alternatives to a joint savings account? · Use a specialised card. Some specialist cards allow others to spend on your behalf while you stay in. In most cases, banks and other financial institutions add an individual to an account as a joint owner, not an authorized signer. Assets that were managed. Couples can use cash in a joint checking account to cover shared expenses such as rent, bills and date nights. · A joint savings account can help you save more. As I mentioned in my previous comment I have accounts at the big 3 (Chase, Wells Fargo and Bank of America). Chase is by far my favorite of. Choose the best account for you and enjoy Online Banking, Mobile Banking Footnote[1], a debit card with Total Security Protection ® - and much more. Joint bank accounts can be a great way for couples to manage their finances together. Some people will only have a joint account for the mortgage or rent and. Best Joint Checking Accounts of September · Joint checking accounts make it easier to manage shared expenses. · Joint account holders may find it easier to. A joint account is a bank or brokerage account shared between two or more individuals. Joint accounts are most likely to be used by relatives, couples, or. Applying for Bank Accounts FAQs. View financial center for a day and time that works best for you. What information do I need to open a joint account? Joint bank account provider reviews. Starling and First Direct are the only Which? Recommended Providers for current accounts and both banks earned five stars. The funds in a joint account could be subject to claims by creditors which did not arise from you. What should I consider before deciding which is best for me? Zeta Accounts are spending & saving bank accounts designed to grow with you. When you sign up, you get one joint bank account, two debit cards, and a mobile app. This article covers how joint bank accounts work, the best savings and chequing joint bank accounts in Canada, how to open one, and their pros and cons.

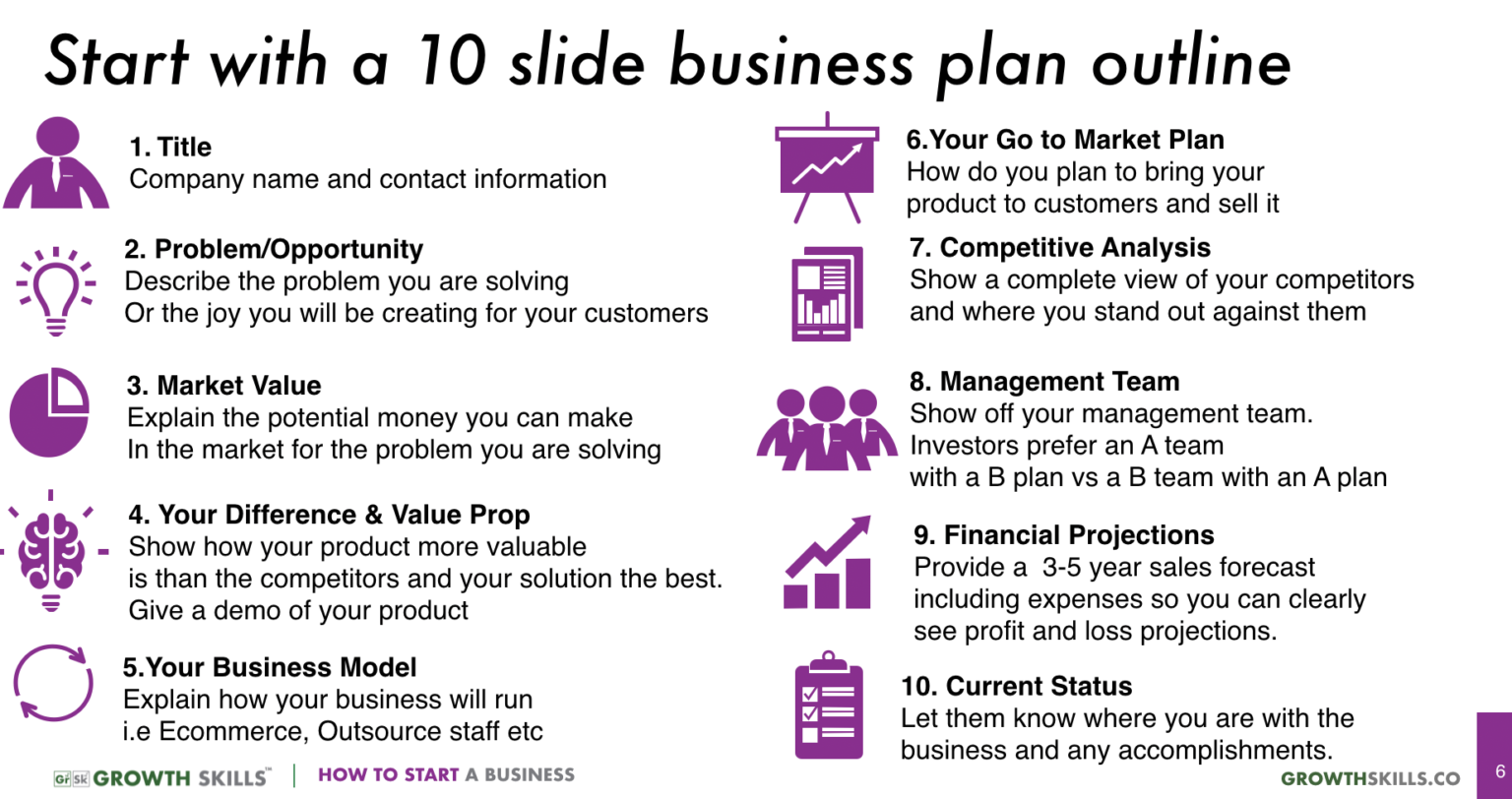

Business Plan Step By Step Guide

1. Company profile · A business description. Briefly describe your company, what it does and where it's located. · Products and services. Provide a detailed. As an entrepreneur or business owner, the first step as you're preparing to write or refresh your business plan is defining your business idea. Whether you plan. A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. What are your end goals? How will you finance your startup costs? These questions can be answered in a well-written business plan. Fledgling business owners can. This definitive step-by-step guide on how to write a business plan will help you to get started with great insights, free templates for each stage of your. How to Write a Business Plan This guide to writing a business plan will outline the most important parts and what should be included in an effective plan. A business plan outlines your business's overall goals, strategies, and operations, providing a long-term vision and plan for your entire business. A step-by-step guide on writing a business plan to catch an investor's attention & serve as a guiding star for your business. A business plan is the way to take your idea and put it into action. As you'll see, it's not just for the investors or the bank's benefit. 1. Company profile · A business description. Briefly describe your company, what it does and where it's located. · Products and services. Provide a detailed. As an entrepreneur or business owner, the first step as you're preparing to write or refresh your business plan is defining your business idea. Whether you plan. A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. What are your end goals? How will you finance your startup costs? These questions can be answered in a well-written business plan. Fledgling business owners can. This definitive step-by-step guide on how to write a business plan will help you to get started with great insights, free templates for each stage of your. How to Write a Business Plan This guide to writing a business plan will outline the most important parts and what should be included in an effective plan. A business plan outlines your business's overall goals, strategies, and operations, providing a long-term vision and plan for your entire business. A step-by-step guide on writing a business plan to catch an investor's attention & serve as a guiding star for your business. A business plan is the way to take your idea and put it into action. As you'll see, it's not just for the investors or the bank's benefit.

In this webinar, you will learn how to write a one-page business plan. You'll see the elements of the one-page business plan, including identifying the. How to Write a Business Plan This guide to writing a business plan will outline the most important parts and what should be included in an effective plan. A business plan removes the uncertainty and what-ifs from the equation. It validates our business ideas, confirms our marketing strategies, and identifies. Writing a business plan allows you to carefully think through every step of starting your company so you can better prepare and handle any challenges. While a. How to Write a Winning Business Plan: A Step-by-Step Guide for Startup Entrepreneurs to Build a Solid Foundation, Attract Investors and Achieve Success with. In this guide: · Introduction · The audience for your business plan · What a business plan should include · Business plan executive summary - the dos and don'ts. A business plan is a written document that describes your business. It may not sound like a lot, but it's an in-depth guide to who you are, what you do, and. The following steps outline the basics of how to create a business plan, as defined by the US Small Business Administration. What is business planning? · What to include in your business plan · Beginner's guide to creating a business plan · My simple 5-step business plan · Best business. These plans should include goals or milestones alongside detailed steps of how your company will reach each step. The process of creating a road map to your. This guide breaks down how to write a business plan, step-by-step, detailing what your document needs to include and what you need to think about. Every thorough plan for a business opens with an executive summary that provides a brief description of the business, a mission statement, the products and. Download Wix's free business plan template. Creating a successful business plan is no easy feat. That's why we've put together a simple, customizable, and free-. In this article, you will learn how to write a business plan step by step, which is a crucial must for all starting entrepreneurs. Nine steps to build the essential business plan · 1. Write an executive summary · 2. Provide company description, mission statement, and highlights · 3. Do your. This bestselling book contains clear step-by-step instructions and forms to put together a convincing business plan with realistic financial projections. A business plan is a written document that describes your business. It covers objectives, strategies, sales, marketing and financial forecasts. This guide sorts it all out following a step-by-step process to help you how to wirte a business plan and generate accurate financial forecasts. We've created this comprehensive guide on how to write a business plan. We break the process down into 9 key steps and offer tips and resources to help you get. Nine steps to build the essential business plan · 1. Write an executive summary · 2. Provide company description, mission statement, and highlights · 3. Do your.

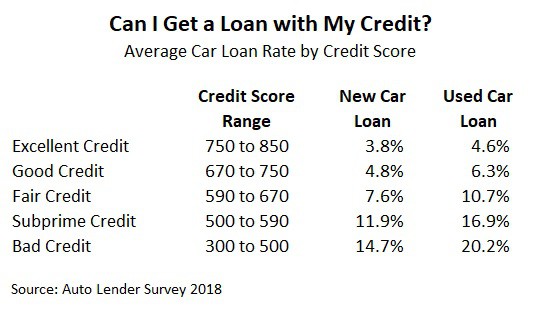

Average Used Car Loan Rates By Credit Score

Credit score range. Average interest rate. to %. to %. to %. to %. to %. Average Used Car. Average interest rates for car loans ; , ; New-car loan, %, % ; Used-car loan, %, %. What is the Average Used Car Loan Interest Rate? As you can see above, the average rate for someone with an average credit score is about %, give or take. How much do you need to borrow? $ Apply your credit rating: Excellent, Good, Average Your APR will be based on your credit score upon submission of a loan. Used car loan rates as low as % are certainly not unheard of, but how low can you really expect your interest rate to go? If your credit score falls. Credit score range. Average interest rate. to %. to %. to %. to %. to %. Average Used Car. Average Auto Loan Rates for Excellent Credit ; Credit Score, New Car Loan, Used Car Loan ; or higher, %, %. New car auto loan interest rate by credit score · Deep subprime (credit scores below ) · Subprime (credit scores of ) · Near-prime (credit scores of The current average APR rate for a person with a credit score when buying a new car is % and when buying a used car. How to Get a Credit Card. Credit score range. Average interest rate. to %. to %. to %. to %. to %. Average Used Car. Average interest rates for car loans ; , ; New-car loan, %, % ; Used-car loan, %, %. What is the Average Used Car Loan Interest Rate? As you can see above, the average rate for someone with an average credit score is about %, give or take. How much do you need to borrow? $ Apply your credit rating: Excellent, Good, Average Your APR will be based on your credit score upon submission of a loan. Used car loan rates as low as % are certainly not unheard of, but how low can you really expect your interest rate to go? If your credit score falls. Credit score range. Average interest rate. to %. to %. to %. to %. to %. Average Used Car. Average Auto Loan Rates for Excellent Credit ; Credit Score, New Car Loan, Used Car Loan ; or higher, %, %. New car auto loan interest rate by credit score · Deep subprime (credit scores below ) · Subprime (credit scores of ) · Near-prime (credit scores of The current average APR rate for a person with a credit score when buying a new car is % and when buying a used car. How to Get a Credit Card.

Used Vehicle: & Newer ; Primary borrower credit score, +, , , ; Max Term, APR. Average Used Auto Loan Rates in July ; Credit Score, Interest Rate ; or higher, % ; , % ; , % ; , %. See current PSECU car loan rates. Use the PSECU car loan calculator to estimate a payment. Explore the latest PSECU new car loan and used car loan options. Get the car you want with Mountain America's help. Finance your car purchase with an auto loan from Mountain America Credit Union. Lock in a great loan rate. Compare auto loan rates in September ; PenFed Credit Union, Starting at %, months, Not specified, Bankrate Award winner for best auto loan. Used Automobile Loan Rates. Term, APR – Fixed Rate as low as. Up to 36 Months Normal credit criteria apply. Rates for approved loans are based on the. As you can see from the above numbers, the best rates for an auto loan can vary significantly, depending on your credit score. (For example, anywhere from %. Rates and APRs were based on a self-identified credit score of or higher New Car Purchase, Used Car Purchase, Refinance, Lease Buy Out. Auto Loan Type. Your credit score is the main factor that determines your interest rate, so it's best to check your credit score before you apply for auto financing. Your. Maximum financing term is 96 months with a maximum loan amount of $75, No credit history required on vehicles less than 10 years old, provided you meet all. The average interest rate on a new car loan with a credit score of is %, while the average interest rate on a used car loan is %. What kind of. Rates as of Sep 12, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. The average interest rate for used cars in is % to % depending on your credit score. In , the average rates were % to % depending on. Let's dive into some hard figures to really drive this point home. According to Experian's State Of The Automobile Market report from , the average new car. Any car finance rate in Canada that is better than the average listed above given your credit score. What is the Average Interest Rate on a Car Loan? In Used car (dealer): Example: A 5-year, fixed-rate used car loan for $32, would have 60 monthly payments of $ each, at an annual percentage rate (APR) of. APR on New and Used Car Loans ; Credit Score. New Car Loan. Used Car Loan ; %. % ; %. % ; %. % ; %. According to Experian, this is the data for interest rates in Credit Score, Average Interest Rate for New Auto Loans, Average Interest Rate for Used Auto. These tips can give you an advantage if you need a bad credit auto loan, where your average interest rate typically reaches double digits if your credit score. It also directly affects the total amount you pay for your car, as lower credit scores automatically imply higher interest rates. On the upside, this means.

Best Online Bank For Cash Deposits

Mobile banking done better. Build credit while you bank. No overdraft fees/hidden fees. Current is a fintech not a bank. Banking services provided by Choice. Online banking and bill payment; Mobile banking and deposits with immediate funds via our new mobile app; Text alerts. Plus, access to: Overdraft. The best online checking accounts have low fees, broad ATM networks and quality customer service. See our picks here. Easily pay bills, send checks, deposit checks, deposit cash. Easily navigate from one online activity to the next, from one device to another. Open an account. My primary online bank is Capital One. You can make cash deposits at CVS and Walgreens. Make cash or check deposits by ATM, in-person or by using the Capital One online mobile app. Explore Ally's online bank accounts with competitive rates. Rated "Best Bank of " by NerdWallet and "Best Customer Service" by Money. Ally Bank, Member. Cash deposits at select Allpoint® ATMs are only available for Capital One consumer and small business checking customers at this time. Cash deposits at select. Choose the best account for you and enjoy Online Banking, Mobile Banking Get cash back with BankAmeriDeals® or round up the savings with. Mobile banking done better. Build credit while you bank. No overdraft fees/hidden fees. Current is a fintech not a bank. Banking services provided by Choice. Online banking and bill payment; Mobile banking and deposits with immediate funds via our new mobile app; Text alerts. Plus, access to: Overdraft. The best online checking accounts have low fees, broad ATM networks and quality customer service. See our picks here. Easily pay bills, send checks, deposit checks, deposit cash. Easily navigate from one online activity to the next, from one device to another. Open an account. My primary online bank is Capital One. You can make cash deposits at CVS and Walgreens. Make cash or check deposits by ATM, in-person or by using the Capital One online mobile app. Explore Ally's online bank accounts with competitive rates. Rated "Best Bank of " by NerdWallet and "Best Customer Service" by Money. Ally Bank, Member. Cash deposits at select Allpoint® ATMs are only available for Capital One consumer and small business checking customers at this time. Cash deposits at select. Choose the best account for you and enjoy Online Banking, Mobile Banking Get cash back with BankAmeriDeals® or round up the savings with.

Get a cash advance on your next qualified direct deposit with MyAdvance from Fifth Third Bank. Here's how to enroll. With this lower overhead, online banks typically offer much higher interest rates on deposit accounts than traditional banks. Can You Open a Bank Account Online. With a First Citizens free checking account, you can manage your money anywhere—without a monthly maintenance fee. Open a fee-free online bank account. Our top three picks for the best online banks are SoFi Bank, Discover Bank and Ally Bank. To help you choose, we at the MarketWatch Guides team reviewed Quontic Bank made our list for its competitive deposit rates, low fees, and massive ATM network. A major selling point: Quontic doesn't charge overdraft fees. Quontic Bank made our list for its competitive deposit rates, low fees, and massive ATM network. A major selling point: Quontic doesn't charge overdraft fees. Use Online Banking and Bill Pay or Remote Deposit for banking, without making trips to the bank. Get Cash Rewards. Earn cash with PNC Purchase Payback. Bank Deposit Limits ; Institution, Limit ; Capital One Checking, One-time cash deposit maximum at an ATM is $5, ; Chime, Three deposits per day, $1, per. Breathe easy knowing we will not penalize you for spending your money. You Choose Your Opening Deposit Amount. Don't break the bank. There is no minimum. Personal and business checking, savings, credit cards, loans and retirement planning solutions since You may also use Zelle to send or receive money right from the Bank of America® Mobile app or Online Banking with no fees. Cash Flow Monitor and Connected. Best at Bank of America: Bank of America Advantage Plus Banking® · Best at Chase: Chase Total Checking® · Best at Citibank: Citi® Simple Checking · Best at PNC. When it comes to climate change, your money is power. You can feel good knowing that your deposits will not fund fossil fuel exploration or production. † By. Start by downloading your bank's mobile app and signing up or logging in to the online banking cash deposits per statement period; standard cash deposit fees. Awarded Best Online Bank of , SoFi Bank offers accounts with high APYs and no account, overdraft, or monthly fees. Open a bank account online today. All you need is your USAA Federal Savings Bank ATM or debit card — there's no deposit slip or envelope required. Cash and check deposits are generally made. Awarded Best Online Bank for no opening deposit by Go Banking Rates. A American Express does not accept ATM cash deposits into your Rewards Checking. A U.S. Bank business checking account helps your money go further with smart online banking tools and personalized support from our business banking experts. Online and mobile banking, including Bill Pay and mobile depositFootnote 3; More than 11, ATMs across the country; Ability to easily transfer money. Log in to Online Banking · Set up Direct Deposit · Personal Schedule of Fees · Request a Debit Card · Deposit Agreement and Disclosures. Checking. Bank of.

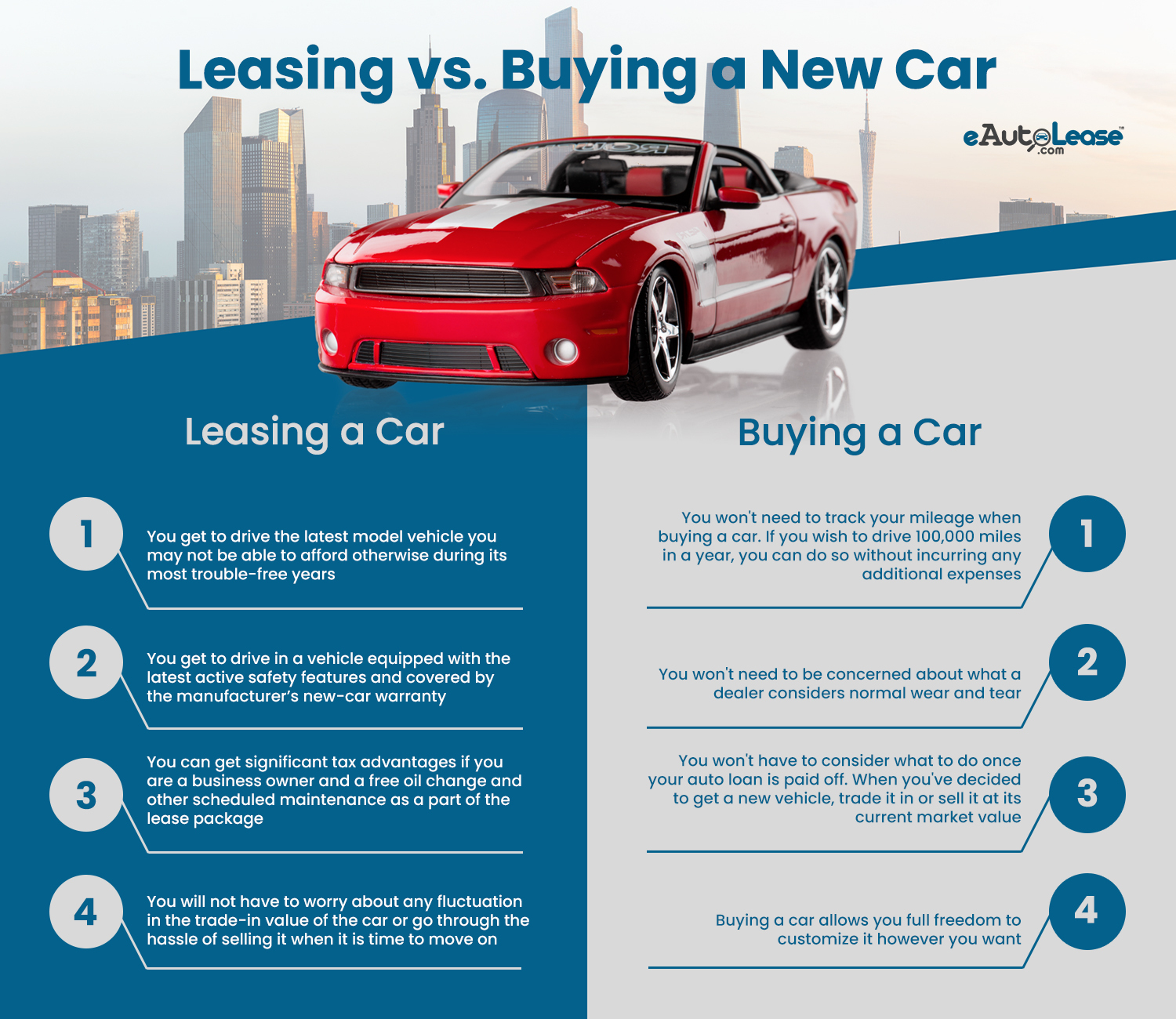

What To Expect When Leasing A Car

7 Costs to Expect When You Lease a Car · 1. Down Payment · 2. Monthly Payments · 3. Acquisition Fee · 4. Money Factor · 5. Return Fee · 6. Extra Mileage Charges · 7. The Lease Return Checklist: 7 Things to Expect When Returning Your Lease · 1. Your New Car, Delivered! · 2. Brief Inspection of Vehicle Appearance and Condition. Every car lease will have stated allowable miles to be driven for the course of the contract. Most car leases are about 10, to 15, miles per year. Most. In simpler terms, to lease a car, you will pay the adjusted capitalized cost minus the residual value (i.e., the vehicle's depreciation), plus a rent charge. Tax benefits: Do you intend to use the leased vehicle for your business? If so, you may be able to write off the lease payment as a tax deduction. Even if you'. Under-mileage: If your estimated mileage will be under your allowance, you can just return the vehicle at the end of the lease. · Over-mileage: What happens if. 1. Lease Specials. In an effort to increase new car sales, manufacturers will often offer specials on new car leases at the start of every month. · 2. Vehicle. In a lease, your payment goes toward the use of the vehicle plus the finance charge. You never pay off any principal. The overall cost of financing during a. Your payments don't build equity as an automobile loan, and payments do. You can still negotiate the terms of the deal, including the length of the lease. 7 Costs to Expect When You Lease a Car · 1. Down Payment · 2. Monthly Payments · 3. Acquisition Fee · 4. Money Factor · 5. Return Fee · 6. Extra Mileage Charges · 7. The Lease Return Checklist: 7 Things to Expect When Returning Your Lease · 1. Your New Car, Delivered! · 2. Brief Inspection of Vehicle Appearance and Condition. Every car lease will have stated allowable miles to be driven for the course of the contract. Most car leases are about 10, to 15, miles per year. Most. In simpler terms, to lease a car, you will pay the adjusted capitalized cost minus the residual value (i.e., the vehicle's depreciation), plus a rent charge. Tax benefits: Do you intend to use the leased vehicle for your business? If so, you may be able to write off the lease payment as a tax deduction. Even if you'. Under-mileage: If your estimated mileage will be under your allowance, you can just return the vehicle at the end of the lease. · Over-mileage: What happens if. 1. Lease Specials. In an effort to increase new car sales, manufacturers will often offer specials on new car leases at the start of every month. · 2. Vehicle. In a lease, your payment goes toward the use of the vehicle plus the finance charge. You never pay off any principal. The overall cost of financing during a. Your payments don't build equity as an automobile loan, and payments do. You can still negotiate the terms of the deal, including the length of the lease.

With car leasing, you're essentially renting the car for a set period. You'll need to return the vehicle to the dealership at the end of your lease. A great. Leasing a car means signing a contract to use a vehicle for a set period under specific conditions. Leasing has similarities to a long-term rental but is. But most lease contracts do have a buyout option that allows you to purchase the vehicle at the end of the lease, or sometimes even sooner. Deciding to buy out. Dealerships tend to offer two main options: buy out the lease or turn in the car (and hopefully buy or lease another one in the process). Choice: When a lease term is finished, car buyers can return or buy the vehicle, or sign a lease for a different vehicle. Extra charges: The vehicle must be. You also do not own the car, which means you have no equity in the vehicle and cannot sell it for a profit. Additionally, you may have to pay extra fees if you. You pay the dealer monthly payments much like renting a house or apartment. You do not gain ownership of the car and you must return the car, or buy it from the. Know how leasing is different than buying. The monthly payments on a lease are usually lower than monthly finance payments if you bought the same car. With a. Auto leases for personal, family or household purposes that extend for a minimum of four months and that do not exceed $25, must comply with Regulation M. Many leases also include an acquisition fee, which a bank charges on every vehicle lease. This $$ fee can typically roll into your down payment. Your. The obvious downside to leasing a car is that you don't own the car at the end of the lease. That means you don't have a trade-in if you decide to purchase a. You agree to lease the car for a set term and certain mileage limits, and return it at the end of the leasing period. There's no obligation for you to purchase. Lessees have several options at the end of a car lease, including doing a lease buyout, buying out the car then reselling it, transferring the lease, doing a. If you lease a car, you do not own it. You get to use it but must return it at the end of the lease unless you choose to buy it. If you buy a car, you own. Under-mileage: If your estimated mileage will be under your allowance, you can just return the vehicle at the end of the lease. · Over-mileage: What happens if. You can buy out the lease before the contract ends or purchase the vehicle at the end of leasing. Then, you can sell the car once you own it. Used cars in. With a lease, when the term ends, the vehicle has to either be returned to the leasing company or purchased for the residual value. In this article we'll. This option would have you buy the vehicle outright. The benefit of this option is that you now own the car and can do anything you want with it. You can sell. It also costs more to insure a leased vehicle than a financed one, so you can expect to pay an extra $ on insurance. If you decide you want out of the lease. Car leasing is not the same as car buying or renting a car. · A car lease is an arrangement in which you pay your leasing company for the right to drive your.

Remote Keylogger For Windows

SpyLogger Classic® is a remote keylogger software designed to support discreet and efficient computer surveillance. It allows us to supervise our child browsing. Select your preferred method for communicating with the device and retrieving data. Keyloggers with Wi-Fi can be accessed remotely, but are slightly less. I've tried 12 keyloggers, and in my experience the best keylogger is Iwantsoft Free Keylogger It's even better that commercial products. By using AnyControl keylogger you can monitor all keystrokes logs on android, windows devices and any iPhone secretly. The term keylogger, or “keystroke logger,” is self-explanatory: Software that logs what you type on your keyboard. However, keyloggers can also enable. Data can then be retrieved by the person operating the logging program. A keystroke recorder or keylogger can be either software or hardware. While the programs. A Windows keylogger undetected by all major anti-virus. Log keys, clipboard, window titles and send logs to a server. - Darkempire78/Windows-Keylogger. Keyloggers or keystroke loggers are software programs or hardware devices that track the activities (keys pressed) of a keyboard. REFOG Keylogger Software – monitor your kids computer activities, chats and social communications with easy online access. Invisible and undetectable for. SpyLogger Classic® is a remote keylogger software designed to support discreet and efficient computer surveillance. It allows us to supervise our child browsing. Select your preferred method for communicating with the device and retrieving data. Keyloggers with Wi-Fi can be accessed remotely, but are slightly less. I've tried 12 keyloggers, and in my experience the best keylogger is Iwantsoft Free Keylogger It's even better that commercial products. By using AnyControl keylogger you can monitor all keystrokes logs on android, windows devices and any iPhone secretly. The term keylogger, or “keystroke logger,” is self-explanatory: Software that logs what you type on your keyboard. However, keyloggers can also enable. Data can then be retrieved by the person operating the logging program. A keystroke recorder or keylogger can be either software or hardware. While the programs. A Windows keylogger undetected by all major anti-virus. Log keys, clipboard, window titles and send logs to a server. - Darkempire78/Windows-Keylogger. Keyloggers or keystroke loggers are software programs or hardware devices that track the activities (keys pressed) of a keyboard. REFOG Keylogger Software – monitor your kids computer activities, chats and social communications with easy online access. Invisible and undetectable for.

Remote installation keyloggers, often referred to simply as keyloggers, are malicious software programs designed to secretly monitor and record. Software keyloggers work similar to hardware loggers but they allow a lot more flexibility. Keylogger software can be installed and accessed through remote. FlexiSPY's keylogger software lets you record keystrokes, monitor search history and back up passwords, chats and more! Runs in hidden or visible mode. With Free Keylogger Remote you can find out what other users are doing on your computer. This program is able to record all keystrokes, Internet activities. Revealer Keylogger combines keystroke logging, screenshot capture, and remote monitoring - all in one app. Free download Revealer Keylogger. Protect your business with keylogger software. Record keystrokes typed by office and remote employees working from PCs, Macs or Terminal Servers. This is done using a remote server that both the keylogger software and the hacker are connected to. On a Windows computer, you can press the Windows. Universal keystroke logging capability. All keystrokes and clipboard content for both local and remote sessions are recorded, including keystrokes entered in. On the other hand, software keyloggers are programs installed on the target computer. They can be embedded in malware or spyware and can transmit the logged. Iwantsoft Free Keylogger discreetly monitors nearly all activities on a computer by registering every keystroke, capturing the content of the system clipboard. The AirDrive Keylogger and KeyGrabber are the market leading hardware keyloggers in terms of features, price, and innovation. Spyrix - Free Keylogger and Monitoring Software. Spyrix helps you to monitor your children, employees and safeguard your business. Free Remote Monitoring. Once installed, Realtime-Spy monitors the remote PC or MAC device in total stealth, and cloaks itself to avoid being detected. Monitors keystrokes, website. Password Protection. Easemon Keylogger has password protection to prevent others from changing your configurations freely. Without the correct password, nobody. What is a Keylogger? As the name suggests, keyloggers—also known as keystroke loggers or keystroke monitoring tools—are a type of monitoring software or. Tanit Keylogger is a simple but powerfull remote python keylogger for MS Windows, Mac OS and Linux OSs. The tool is named after the Phoenician chief goddess. Periodic Data Upload: Software keyloggers might periodically send the captured keystrokes to a remote server controlled by the attacker. This allows the. Keylogger software that silently records keystroke, all email and Remote installation of client modules through the network. % stealth work. Top 11 Free Keyloggers for Employee Monitoring in · 1. Spyrix · 2. Xnspy · 3. Refog · 4. Elite Keylogger · 5. Actual Keylogger · 6. Iwantsoft · 7. Revealer. It can be either hardware- or software-based. The latter type is also known as system monitoring software or keyboard capture software. Why are keyloggers used?

1 2 3 4 5